2022 Tax Season Planning

Tax Season is approaching. We're hard at work preparing for it. Here's what's coming.

Hello out there!

Let’s get a little bit of housekeeping out of the way: you’re receiving this email because Crayon Advisory either prepared your 2020 tax return, is currently preparing your (delinquent) 2020 tax return, or we’ve discussed preparing your 2021 tax return. Behind the scenes, I’ve been gearing up for next year’s tax season. And I’ve got some things and information to share with you!

November is when many start getting a little bit anxious about the next tax filing season - what can you do? What do you need to be doing? As with almost all questions, that really depends. For right now, if you’re itching to do something, could you make sure I have your best email to receive information about your tax return?

For now though, we’ll dive into some announcements.

New for the 2022 Filing Season (2021 Tax Returns) - Windows

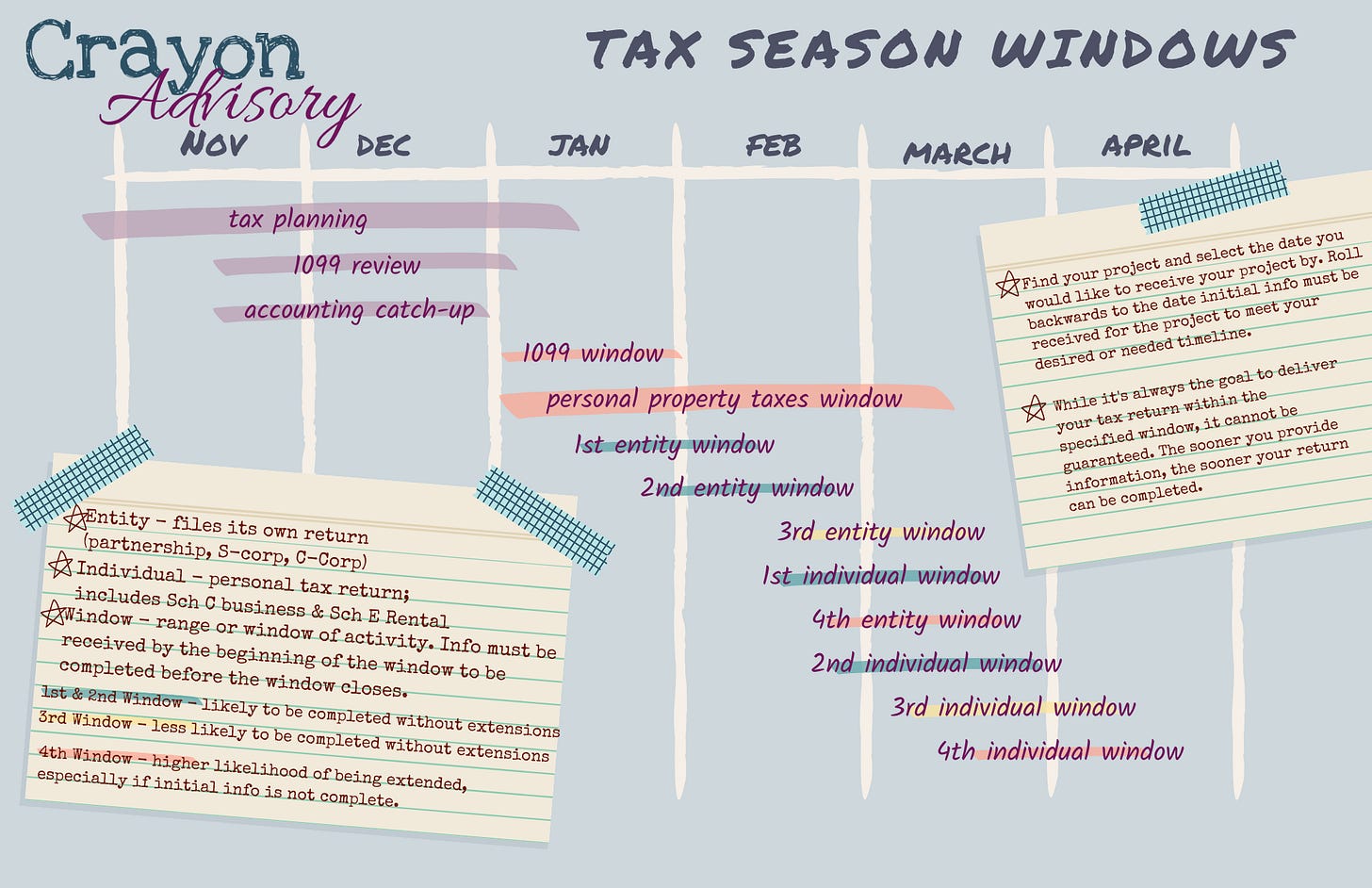

No, I don’t mean the operating system. Beginning with the 2022 filing season (usually 2021 tax returns), Crayon Advisory will be implementing a Window System. Each type of return will have four windows they will slot into. Each window will have final dates during which information will need to be provided. If additional information is necessary, you will be given a deadline by which that information will need to be received in order to stay in your window. Generally speaking, that deadline will be 1 - 5 days from the request.

These windows aren’t a promise or a guarantee. They are a framework and a guideline to help us both work together more closely and efficiently. As we get closer to tax season, you’ll get a bit more information about the specifics of these windows, what the deadlines are, and why they exist.

Firm Priorities

Returns and other projects are generally completed on a first in, first out (FIFO) schedule, with a few caveats regarding priority. Fair or not, these are priorities that have to be met.

Returns with K1s being delivered to owners who are not having their return(s) prepared by Crayon Advisory

Returns with known or projected large balances due ($10,000 or more)

Returns with known or projected significant changes in income from 2021 to 2022

Returns with complete information provided in the initial information

Finally, extensions are not a bad thing. It's only November, and, yes, I'm already talking about extensions. Some prefer to plan to extend. If that's you, preparing your extension early can make that process smoother. Some end up needing to extend because information is missing or there are open questions that need to be resolved. Sometimes, we're just out of time to prepare the tax return. If your return is extended, your tax will still be due on the due date of the return. We will prepare an estimated amount of tax due for the tax return. Extensions are an extension of time to file, not an extension of time to pay.

Tax Return (and other Projects) Cycles

The tax return preparation cycle can get quite complex. There are several places for things to go right, and several for them to go sideways.All the planning and preparation in advance helps things go smoothly. This includes completing your organizer and uploading complete information. You can assume if I’m asking for something, I really do need it. If it doesn’t exist, I need to know it doesn’t exist. If I don’t have everything, or questions are unanswered, I can’t complete the project.

Crayon Advisory Seasons

One last thing before we go. If the past year and the continuation of Marchternity has taught me anything, it's that I have to operate in the rhythm of the seasons the deadlines dictate. That includes time for rest, re-focusing, and rejuvenation as well as focus on activities at certain times of the year. This doesn’t mean other projects aren’t being worked on, or that I’m only doing one thing. Or that a focus may not be extended a bit. It is the starting point out an outline for what’s happening and when. The end of 2021 and all of 2022 will be running on these seasons. You can catch the current season, as well as other useful and helpful information, right here.